what is a quarterly tax provision

Topics covered in this edition. The entry to income tax expense will be a debit because you are increasing the expense account.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Current income tax expense and deferred income tax expense.

. Income tax provisions determined under the general recognition and measurement requirements for accounting for income taxes as per ASC 740-10 The estimated ETR includes the anticipated effect of income tax credits and. This rule is altered slightly for high-income taxpayers. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports.

Tax filings are a cyclical need but changes to accounting standards and tax laws impacting your business are occurring year-round. The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever-increasing scrutiny due to its significance to the operating statement. You do quarterly reviews less substantial in scope than an audit.

The deferred tax calculation which focuses on the effects of temporary differences and other tax attributes over. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. This includes your federal income taxes your payroll taxes Social Security and Medicare your state income taxes and if incorporated your state and federal unemployment insurance payments.

Similarly in case of payments to non-residents the applicable withholding tax rates depend upon the applicable domestic tax provision and relevant treaty provisions whichever is more beneficial. A companys current tax expense is based upon current earnings and the current years permanent and temporary differences. Financial year end date can be different from tax year end date thus entity cannot exactly calculate the tax liability to be.

Quarterly Hot Topics is now available. Annual and Quarterly Tax Provision Review. The provision can be calculated on a monthly quarterly or annual basis as required.

Recent editions appear below. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences. Provision for Income Tax.

Save time and ensure accuracy with this powerful tax provision software. Example 1 No Discrete Items Calculate the quarterly tax provision and the ETR for the quarter. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

The form has been used to report other items as well most recently the coronavirus COVID-19 pandemic tax. Provision for Income Tax is the tax that the company expects to pay in the current year and is calculated by making adjustments to the net income of the company by temporary and permanent differences which are then multiplied by the applicable tax rate. 16343 Interim provisionincome from equity method investments.

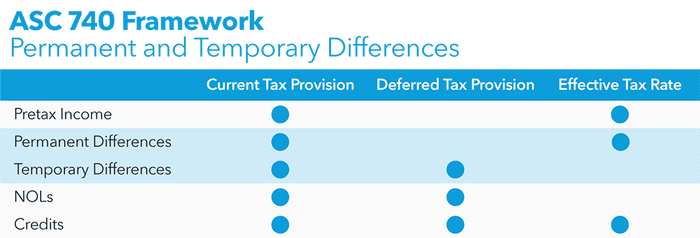

A tax provision is comprised of two parts. The most powerful ASC 740 calculation engine on the market our software solves the technical and process issues involved in calculating your income tax provision taking manual risks out of the equation. You pay at least 90 of the tax you owe for the current year or 100 of the tax you owed for the previous tax year or.

Provision for Income Tax Calculation. Entity can have accounting policies and estimation process differ from taxation rules. IRS Form 941 Employers Quarterly Tax Return replaced these forms more than 70 years ago and has been used by businesses to report federal income tax withholding Social Security tax Medicare tax and Additional Medicare tax.

These quarterly payments must be post-marked by April 15th of the current year June 15th September 15th and January 15th. The latest issue of Accounting for Income Taxes. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

The provision is the audit part of tax. Provision for Income tax will be calculated on the income earned Income Earned. Calculate the quarter effective tax rate Q1 Q2 Q3 Q4 Projected full-year AETR 40 35 37 35 Quarterly book income 400 100 200 700 YTD book income 400 500 300 1000.

Yes Im studying AUD right now the company estimates their taxable income for the year and every quarter you adjust the provision to correct what was. CrossBorder Solutions Senior Tax Manager Howard Telson breaks down the differences between preparing the quarterly provision 10-Q and the annual provision 10-Kand how each communicates to stakeholders about the financial health of a company. Other types of provisions a business typically accounts for include bad debts depreciation product.

You owe less than 1000 in tax after subtracting withholdings and credits. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. This issue discusses several important developments and related ASC 740 considerations.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding quarterly estimated tax payments or a combination of the two. Therefore although you may pay taxes annually or quarterly you should do an adjusting entry during each period for which you produce an income statement. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax basis ie the investee would provide taxes in its financial statements based on its own estimated annual ETR calculation.

Uncertain Tax Position Review. Typically this is represented quarterly with each earnings. In recent years tax-related issues have been a primary reason for restating financial statements and accounting for.

The IRS will not charge you an underpayment penalty if. Calculate the quarterly tax provision c. Rather than spending resources to train and maintain a full-time tax staff a growing number of businesses.

The provision is always calculated on a year-to-date basis no matter how frequently it is calculated. The provision for tax is based on profits in entitys income statement and reasons why it is a provision and not a liability. The adjusted net income figure is then multiplied by the applicable.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

The Standard Magazine Helping People Human Rights Campaign Learning

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

425 02 Chartered Accountant Mumbai Chartered Accountant Job Hunting Job Posting

For Small Assesses Compliance With Indian Tax Laws Has Always Been A Challenge Forcing Such Assesses For Compliance May Not Yiel State Tax Schemes Composition

Why It Matters In Paying Taxes Doing Business World Bank Group

How To Make Gst Tax Liability Payment In 2021 Liability Business Updates Business Advisor

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Apc Distributor Rebate Agreement Intended For Volume Rebate Agreement Template 10 Professional Templates Ideas Professional Templates Templates Agreement

Purchase Management Icons Business Icon Business Icons Vector Management

Resume Tax Manager Tax Manager Resume Becoming A Tax Manager Is A Vital Job To Applying For That You Must Build An Exce Manager Resume Resume Resume Tips

Car Donation Tax Deduction Simplified Http Www Irstaxapp Com Car Donation Tax Deduction Simplified Donate Car Donation Tax Deduction Tax Credits

Gstr 3b July 2017 To Sept 2017 Unilateral Rectification Invalid Tax Income Tax Tax Exemption

Gst Collection In June 2021 Slips Below Rs 1 Lakh Crore Collection June Place Card Holders

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics