child tax credit november 15

Free means free and IRS e-file is included. To reconcile advance payments on your 2021 return.

Need Health Insurance Young Invincibles Health Insurance Plans How To Find Out Health Insurance

If you are eligible for the Child Tax Credit but dont sign up for advance monthly payments by the November 15 deadline you can still claim the full credit of up to 3600 per child by filing your taxes next year.

. The agency is tapping bank account information provided through individual tax returns or. Max refund is guaranteed and 100 accurate. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

CBS Baltimore -- The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on November 15. Child tax credit november 15 Thursday June 23 2022 15 deadline according to the IRS will normally receive half of their total child tax credit on Dec. An estimated 77000 Child Tax Credit payments were sent to 124000 qualifying children in the Fifth Congressional District last.

Get your advance payments total and number of qualifying children in your online account. He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. The fifth payment date is Monday November 15 with the IRS sending most of the checks via direct deposit.

The American Rescue Plan expanded the Child Tax Credit to provide working families with advance monthly payments of 250 300 per child. If you are eligible for the Child Tax Credit but did not sign. Families must claim Child Tax Credit by November 15 to receive payments this year.

The deadline for families to sign up for the enhanced child tax credit and get any money this year is Nov. If youre eligible for the child tax credit and sign up in time youll receive a single payment from the IRS in December for one-half of the. Most families who have filed their 2019 and 2020 taxes already receive this credit.

The actual time the check arrives depends on the payment method and. Complete IRS Tax Forms Online or Print Government Tax Documents. Low-income families who have not received advance payments because they do not typically file a tax return have until Monday night Nov.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The stimulus check part of President Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. However the deadline to apply for the child.

Most families are automatically receiving monthly payments. Enter your information on Schedule 8812 Form 1040. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Start Your Tax Return Today. Ad All Major Tax Situations Are Supported for Free. Ad E-File Your Taxes for Free.

15 to sign up to receive a lump sum of up to 1800 for. The stimulus check part of President Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. Most of the millions of Americans.

15 deadline if theyve not signed up yet for advance payments. NOVEMBERs child tax credit cash will be sent out to parents in need across the country next week. And low income families face a Nov.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. The American Rescue Plan signed into law by President Biden on March 11 2021 increases the Child Tax Credit CTC to provide up to 300 per month per child under age 6 and up to 250 per month per child ages 6 to 17. Claim the Child Tax Credit by November 15.

The next child tax credit payment arrives Nov.

Nick Sutton On Twitter Childrens Hospital Turn Ons U Turn

Canadian Tax News And Covid 19 Updates Archive

November December 2018 Beauty Marketing Spa Inspiration Salon Manager

The Oklahoma State Building And Construction Trades Council Is Hosting Its Fifth Annual Apprenticeship Open House On N Apprenticeship Building Trade Open House

Still Need Health Insurance For 2018 We Can Help Click Or Call Www Morrisonh Best Health Insurance Health Insurance Plans Health Insurance Open Enrollment

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

Copays Vs Coinsurance Back To The Basics Health Insurance Plans How To Plan Healthcare System

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Daily Banking Awareness 13 14 And 15 October 2020 Banking Awareness Financial

Mcq 08 Assessment Test Concept Assessment

Idiots American Jobs Hiring Veterans The Twits

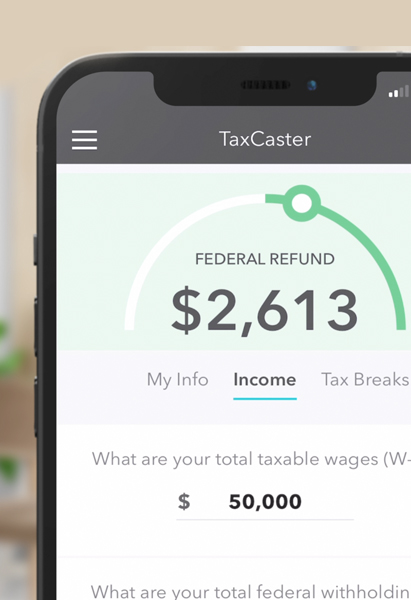

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Banking Awareness Of 13 14 And 15 November 2021 Awareness Financial Banking

Turbotax Deluxe Online 2019 Maximize Tax Deductions And Tax Credits Tax Deductions Tax Credits Turbotax

Allan J Wilson Difference Between An Income Tax Rectification Request And Revised Return Income Tax Income Tax Return Income